High interest rates and financial pressures have made it more important than ever for finance teams to better manage cash flow, and several startups are looking to help.

One such company is Panax, a two-year-old Israeli startup that just raised a $10 million Series A round led by Team8 with participation from TLV Partners.

Startups have had the good fortune of following the CFO stack by streamlining processes and freeing up time to work on strategic tasks. SVB's collapse has provided a tailwind for the money management sector, which includes companies such as Embat, Kyriba, Statement and Vesto.

Unlike some of these, Panax focuses on mid-sized and large companies in traditional industries such as manufacturing, logistics, and real estate. They need more than startups, but they don't always have large finance departments that traditional solutions can accommodate.

Targets aside, Panax wants to differentiate itself not only by its scope of investment accounts and lines of credit, but also by its services.

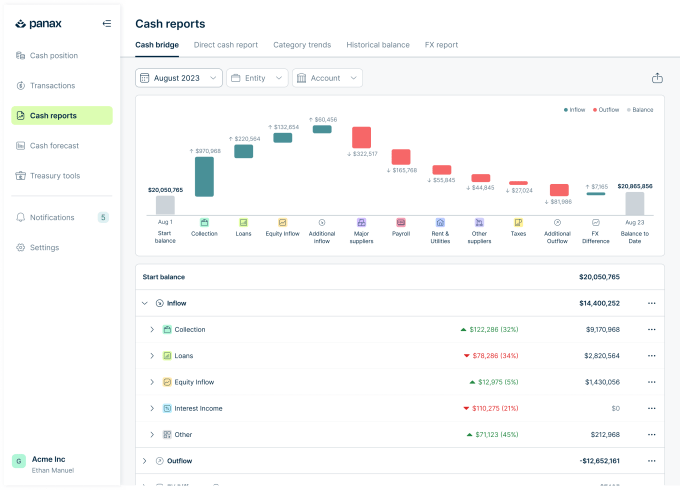

Panax CEO Noam Mills told TechCrunch that while cash flow visualization is useful, Panax wants to do more than provide dashboards. She believes that to help clients, “we need to use data to understand what really matters, influence those decisions, and help clients manage.” [their treasury]”

This value proposition appears to resonate with Panax's early adopters, including companies such as beauty-focused public company Oddity, which saves time and money by automating cash management.

This brings total funding to $15.5 million, following a $5.5 million seed round led by TLV Partners. This new round will help Panax expand its go-to-market approach and build a stronger AI and data team now that it has enough data. Mr. Mills said.

AI is already playing a key role at Panax. AI can help startups make sense of all the financial data they have compiled, but it can also identify insights and predict cash flows. For Mills, where AI really helps is in uncovering action items. “In many cases, there is no formal treasury. […] That's why we see AI as a great enabler to be proactive and flag the right clients. ”

Image credit: Panax

Panax's target customers are businesses with complex financial management needs. They typically operate currencies in multiple locations. Foreign exchange is one aspect that Panax can help optimize, which could bring additional benefits for the company beyond his SaaS model, where prices are set based on the complexity of each customer's business. There is a gender.

There are many stakeholders looking to gain share by helping companies optimize their cash flows. For example, you can apply for a loan, request working capital or a line of credit from the interface of your banking app or accounting software. However, Panax has cards that can be used as a one-stop financial management dashboard that integrates recommendations and forecasts.

Panax's goal is to eliminate the need for finance teams to go elsewhere to execute the decisions they need to make, Mills said. “[That] If we provide them with insight, they can move more cash into interest-bearing accounts. We think building that functionality into our platform is very closely tied to our value proposition, and those are also things that we're developing across a variety of use cases around money movement. ”

Mills' understanding of these needs comes from her experience in private equity, which she shares with Chief Business Officer and co-founder Niv Yar. However, her personal history is quite unique. Prior to her roles in PE and corporate finance, she was an Olympic fencer representing Israel and won several titles in her home country.

When asked what her background as an athlete and her role as a CEO have in common, she highlighted similar psychological requirements, such as perseverance and the ability to deal with uncertainty. However, while fencing is an individual sport, running a company is “more like a team sport.”

After the Series A round, Panax will expand its New York office and Jarl will move there, but R&D will remain in Israel. So is Sefi Itzkovich, his CTO and third co-founder of Panax. He previously worked on machine learning at Facebook after Otonomo, where he was CTO, went public through his SPAC.

“There is competition for talent everywhere. [but] Our deep roots in the Israeli R&D community through our CTO and founding team give us a bit of an edge in the competition for talent,” Mills said.

Mills expects network effects will also play a role in New York City, where Team8 has offices. But she and her co-founders chose the city because of its greater overlap with Israel's time zone than the Bay Area and its relevance to fintech. “The center of it is more in New York and the East Coast,” Mills said.