The European Union has thrown a spanner into chipmaker Nvidia's proposed takeover of Tel Aviv-based AI workload management startup Run:ai. The deal, announced in April, has a price tag of $700 million, according to our sources, and was completed by the EU side following a request from Italy's competition regulator under the EU Merger Regulation (EUMR). It will be considered.

The proposed transaction does not meet the EUMR standard notification threshold. However, EU law requires national regulators to notify the European Commission of a transaction if they believe it poses a significant risk to domestic competition and could affect trade within the single market. is recognized.

“Italy has submitted a referral request to the European Commission under Article 22(1) EUMR. This article allows Member States to submit to the European Commission any trade that does not have EU aspects but is within the single market. ”, the European Commission said, adding that it could request the review of mergers that could have a significant impact on competition in the territory of the requesting Member State. he wrote in a press release Thursday.

Accepting an introduction means that the EU agrees that the proposed transaction meets the criteria for an introduction under Article 22.

“In particular, this transaction could have a significant impact on competition in the market in which NVIDIA and Run:ai operate. The market is likely to extend at least across the European Economic Area and therefore also include reference country Italy. “included,” the EU wrote. “The Committee also concluded that it was best placed to investigate this transaction given its knowledge and anecdotal experience in the relevant markets.”

The European Commission is now asking NVIDIA to notify the deal. This is a formal measure and means chipmakers will have to produce a document informing the bloc's competition enforcer of the details of the proposed merger in order to assess the impact.

Nvidia cannot execute the transaction until it notifies the Commission and obtains permission. Therefore, referrals can add at least a few weeks to the timeline for closing. But if the EU's preliminary examination identifies specific concerns, the bloc could move into a deeper investigation, potentially leading to months of delays and increased uncertainty.

Big tech companies have long enjoyed minimal oversight over their (killer) acquisitions of startups and smaller rivals, but now regulators have recognized the anticompetitive legacy of long inaction. , the approach has changed in recent years. Few platform giants gobble up market power.

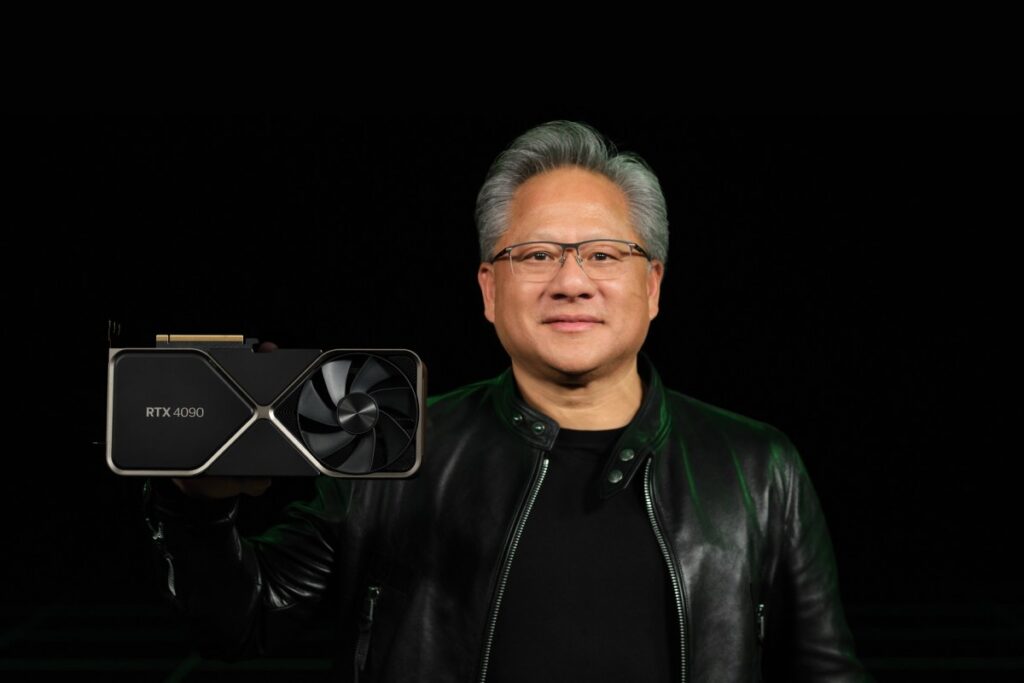

AI is a rapidly evolving software field where innovation relies on access to a small number of key inputs, such as graphics processing units (GPUs), which Nvidia is gearing toward training AI models. Therefore, rapid reproduction of the market is expected. Concentration issues are prompting greater vigilance from antitrust enforcement officials.

However, there are no more difficult actions for now. So it will certainly be interesting to see what the committee's review concludes here.

Nvidia has been contacted for comment.