Critical event management (CEM) software company Everbridge will be taken private and acquired by private equity giant Thoma Bravo in a $1.5 billion all-cash deal.

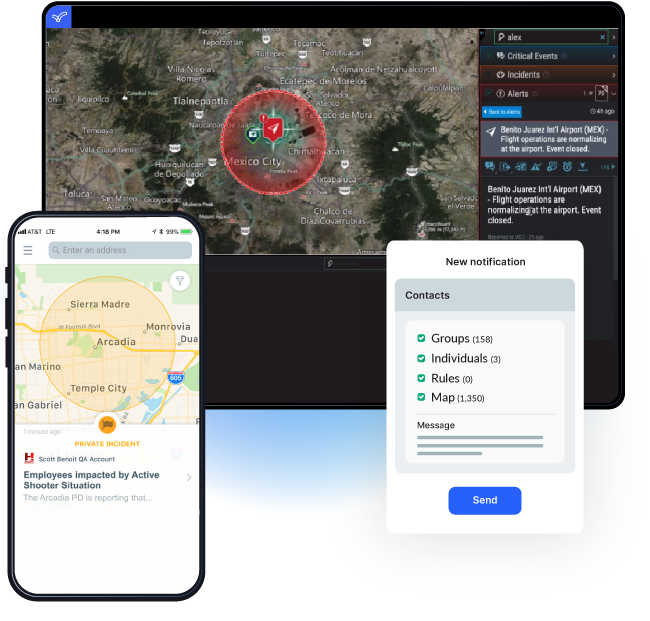

Founded in 2002 as 3N Global, Everbridge helps governments and businesses across all industries respond to emergencies. This includes risk intelligence to help assess the threat landscape where employees live and travel, and mass notification tools to communicate effectively. Important messages during bad weather or terrorist attacks.

Everbridge listed on the Nasdaq in 2016, and its stock price hit an all-time high in September 2021. The company's market capitalization reached $6.4 billion, but within four months it had fallen by more than two-thirds. The situation has not improved, and the company's valuation has remained below $1 billion for the past six months.

event bridge. Image credits: event bridge

Premium plan

Thoma Bravo, a private equity firm known for acquiring underperforming enterprise software companies, on Friday effectively paid a premium of more than 50% to Everbridge's market capitalization. However, looking at the volume-weighted average price (VWAP) over the past three months, this trade represents a premium of 32% for him, giving shareholders a profit of $28.60 per share. .

Thomas Bravo believes that Everbridge's suite of SaaS tools will help manage these risks at a time when geopolitical instability is expected to increase due to a number of elections, in addition to existing threats related to climate change and economic headwinds. We clearly see this as essential for companies seeking to manage their

“We look forward to working with Everbridge to expand our ability to take advantage of opportunities in the expanding market for risk, compliance and safety solutions,” Hudson Smith, partner at Thoma Bravo, said in a press release. . “Everbridge's product portfolio is already used by some of the world's most respected companies and organizations to comprehensively monitor risk and manage critical events, and to support product innovation and We continue to see a broad runway for profitable growth.”

The deal still requires certain regulatory and shareholder approvals, but the company said it expects to close in the second quarter of 2024.