As an interest rate Returning to historical norms, the world has returned its focus to the cost of capital and the generation of free cash flow. In order for companies to adhere to traditional heuristics like the Rule of 40 (i.e., the idea that the sum of revenue growth and profit margin must equal 40% or more, a metric that Bessemer helped popularize) We are working hard. Executives at both private and public cloud companies agree that free cash flow (FCF) margins are just as important (if not more important) than growth, and that the trade-off is he says 1:1. I often think about it. Many finance executives love the “Rule of 40” for its clarity, but placing equal emphasis on growth and profitability in late-stage businesses is flawed and leads to bad business decisions. I am.

our view

Growth must remain a top priority for companies with adequate FCF margins. There are good reasons to emphasize efficiency, but Traditional Rule of 40 Mathematics Is Completely Wrong When a company approaches break-even point and has positive free cash flow,

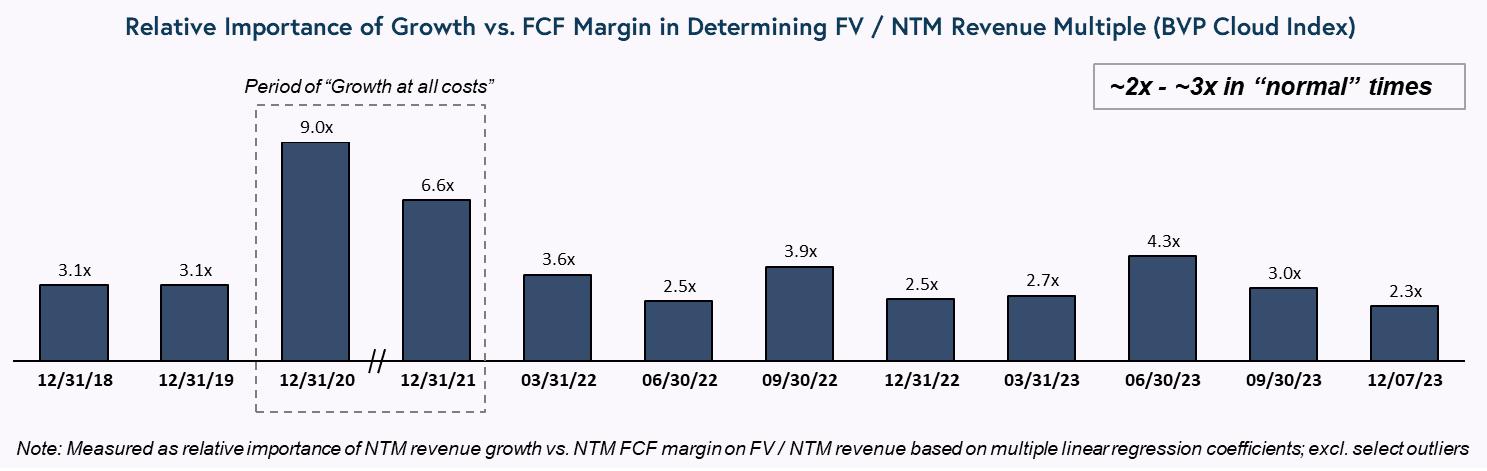

The world has hyper-rotated to an FCF margin mindset instead of a growth mindset, which is counter to efficient business growth. Long-term models show that growth should be valued at least two to three times more than his FCF margin, even in tight markets.

Equivalent emphasis on growth and profitability in late-stage businesses is flawed and leads to bad business decisions.

why?

An increase in margin has a linear effect on value, but an increase in growth rate can have a compound effect on value. We provide detailed calculations below, but when we backtest the relative importance of growth and FCF margins, the correlation of public market valuations confirms it. Actual ratios vary widely in the short term (ranging from about 2x to about 9x over the past few years), but over the long term they are typically 2x to 3x growth value over profitability. It comes down to proportions.

Even the most conservative financial planner recommends that you can safely use a growth rate of up to 2x for late-stage private company profitability. Publicly traded companies with a low cost of capital can use multiples of up to 2-3x (as long as growth is efficient).

Image credits: Bessemer Venture Partners